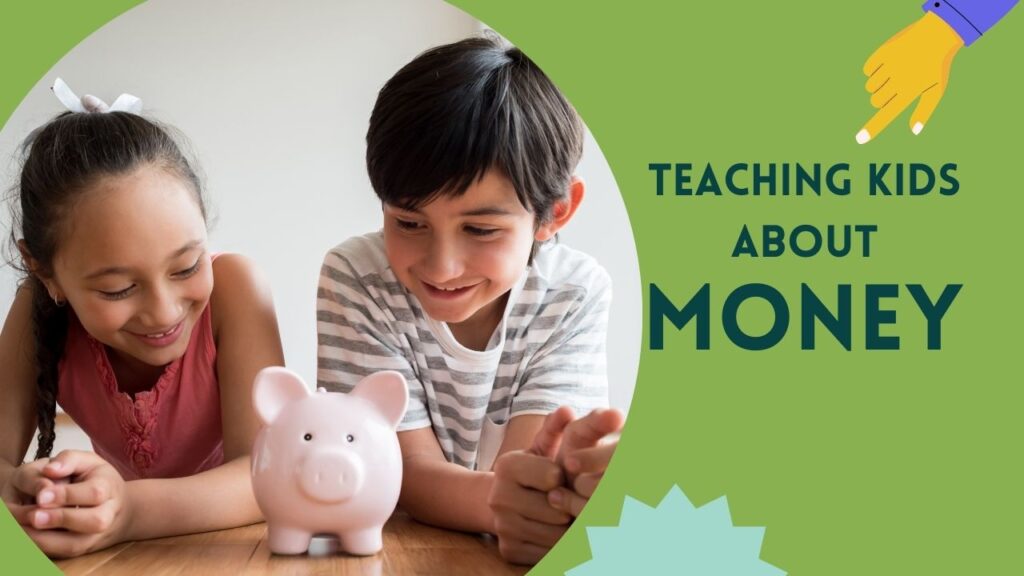

Teaching Kids About Money (Games and Activities)

All parents want their children to do well in life. First, they take charge of their kids` education and try to promote social bonding. Сaring parents also share their savings with grown children. Moms and dads believe that supplying 18-year-old kids with such resources as money or cars lays a foundation to build upon in the future. In fact, it’s Ok if parents provide financial support.

Still, most of the caregivers didn’t teach kids how to get good with money as a child. That’s the reason why many young adults waste all the savings they get from their parents. Moreover, those who earn money themselves also tend to leave on a shoestring because of financial illiteracy. If you are a parent of a preschooler, it’s time to delve into basic budgeting for kids. Fortunately, there`re a lot of games and activities on the topic.

Money Management for Kids

A group of scientists in the Journal of Family Issues proves that financial behavior influences socialization and in particular personal relationships. The explanation is simple. Young adults that were taught how to earn money as a kid experience minor concerns about the current financial situation. Subsequently, the less nervous a person is, the less stress he experiences. That also means less pressure on a relationship.

It turns out that parents must discuss financial and budgeting issues with their sons and daughters. Plus, no less important is to set an example. Let’s talk about it.

How to Earn Money as a Kid?

It’s a controversial issue. Some people believe that children shouldn`t do work for money. Their opponents argue that it makes them more financially savvy instead. Anyway, the most common ways to make money as a kid are:

- Sell lemonade;

- Walk a dog;

- Sell crafts;

- Wash a car;

- Babysit;

- Do housework

- Grow vegetables and sell them (this could be a fun spring activity)

Make sure your kid sees the boundary between own responsibilities as a family member and an opportunity to make a profit. If not, you are at risk of raising an egocentric young adult. Money is also a means to praise your child. You can use it as a part of reward charts system.

For more so-to-say advanced kids there are other ways of earning money:

- Invest;

- Start a blog;

- Run a YouTube channel;

- Write content for web-cites;

- Do art and sell it.

How to Teach Preschoolers About Money?

Parents can start the financial education process when their child is in kindergarten. It’s the right time to explain to him such basic things as what money is and how to take advantage of it. Long lectures won`t work but games are exactly what is needed. Also, exciting activities can motivate boys and girls to learn more about money.

Let Kids be a Buyer

Children copy their parents’ habits. Still, by the age of 7, they form their wants. Thus, once your little one ceases putting coins into his mouth, give him a chance to manage it more effectively. When in a supermarket, explain to them what expensive and cheap mean. If possible, give him cash to pay himself. Don`t forget to take a receipt and then analyze it together. Such interaction has more educational effects than a ten-minute lecture.

Involve your kid into making minor purchases and let him act independently. Tell him to buy such cheap products as bread, a bottle of water, or milk. Encourage him to sum up prices and choose the goods he needs.

Money is a tool to achieve some of your goals and desires. Make a vision board together with your kids to help them know what their goals are.

Use a Piggy Bank

Spending money is easy while saving can cause internal struggle. Well, it’s always tempting to buy sweet candy instead of giving up this idea to save money for something else. Yet, the very process of filling the piggy bank may bring children much pleasure. Use a glass one to see how the amount of coins increases.

Always set a goal. Children should have a materialized aim. Plus, they should extremely want it. Set short-term goals first. When kids get older, they are ready to save for a longer time.

Money Sorting Mats

It`s a kind of table on which kids are supposed to lay coins of the corresponding denomination. Find a mat with a picture of coins to make the task easier. Give your child different coins and help him to sort them. Then, discuss their features and tell what a real coin looks like to avoid a fake one. Also, think of the goods one can buy for a certain amount of cash.

Could We Have..?

Imagine you and your kid are at a restaurant. Make a menu and write down prices. Give your kid a sum of money, especially in coins. Let him make an order and pick up the tab. At first, use prices that are easy to pay off – 25 cents, 50 cents, a dollar. Then, make him add up by setting prices like 75 cents. Also, give your child fewer bills and more coins to encourage him to use cents when run out of paper dollars.

Value of Giving

Generosity isn’t only a virtue but also a cure for greed. One’s happiness shouldn’t depend on the wealth level. The easier it is for a person to part with money, the less stressed he is. Make a giving jar to collect money. Spend them every month on a good deed. Let your little one decide whom he wants to help. It also cultivates a sense of gratitude.

Managing Money for Elementary Students

First pocket money appears at school. Kids should be ready to manage them wisely.

Make a Decision

Children in this age group are old enough to see the opportunity cost. When teaching kids about money, show them the possibilities they can get or lose. “If you buy this tablet then you cannot afford new extra shoes”.

Grow the Finances

Smart money is investing now. Try out a cash app for kids to avoid big financial losses and learn basic knowledge. Besides, kids investing apps are a solution for busy parents and independent children. However, you should keep an eye on your little one and start running an app together.

Take a Walk

Money management for kids is also about controlling emotions and avoiding impulse purchases. Advise your kid to switch his attention for at least half an hour before setting a transaction. 40% that he’ll change his mind and reject the idea. If not, let him spend his money.

Conclusion

The skill of spending personal savings appropriately is a must-have now. It’s as essential as the ability to read or write. Good financial management skills are also one more healthy habit that helps live happily. Now that you know how to teach kids about money, be persistent, and your children will become successful young adults one day.

More articles

A Teacher And Mom’s Perspective On Growing Emotional Intelligence In Children

Have you ever asked yourself, “How do I help my child understand their feelings and handle them in a healthy way?” If yes, you’re not alone. As a teacher and a mom, I’ve heard this question from parents in school meetings, in casual chats, and even during pick-up time. The good news is, emotional intelligence […]

Core Values for Kids: Teaching Character, Responsibility & Kindness

Helping children understand who they are and what matters to them is an essential part of emotional and social development. One of the most effective ways to build character is by teaching core values early. Whether you’re a parent, teacher, or counselor, having a list of values for kids or a list of core values […]

When Do Kids Start Reading? A Parent’s Guide to Early Literacy and Chapter Books

One of the most common questions parents ask is “When do kids start reading?” Understanding reading milestones can help you support your child’s literacy journey with confidence and patience. While every child develops at their own pace, research shows predictable stages of reading growth. From recognizing letters to reading their first chapter book, this guide […]